AdWords Target CPA Bidding: A Case Study

Google Ads has many different settings and ways to control cost and bids in the auction. One way to do that is through Automated Bid Strategies. Google automatically sets bid amounts based on your set campaign goals. In this article, we will focus on what Target CPA is and when to use this automated bidding strategy.

Target CPA can be a good choice if you are looking to help automate bids. It’s also good for maximizing conversions based on a cost-per-conversion goal.

Below we’ll take a look at what Target CPA is, some benefits and drawbacks, key considerations. We also highlight two different case studies, both instances showed positive results. However, one is a case for using Target CPA while the other is a case against it.

What is Target CPA Bidding?

Target CPA bidding is an automated bidding strategy in Google Ads that automates bids. It helps get as many conversions as possible at the target cost-per-action (CPA) you set. This strategy uses Google’s machine learning to automatically optimize your bids instead of having to manually adjust them.

How is Target CPA Used?

Target CPA has a cost-per-acquisition goal that you set, which can be based on any conversion. Including cost-per-sale for an e-commerce website or cost-per-lead for a lead generation website.

Having a Target CPA or CPA goal is one of many ways to define what your KPIs are to optimize an account and measure its performance. Other common key metrics may often include a Return on Ad Spend (ROAS) goal or to maximize conversions.

Pros & Cons of Target CPA Bidding Strategy

As with any bidding strategy, there are pros and cons to using Target CPA. Before even considering it you need to have conversion tracking installed on your site. You also need data for Google’s machine learning to make smart decisions.

Pros

- Efficient Account Management – Target CPA helps automate bidding, which means less time watching and adjusting bids.

- Machine Learning – Aside from just big management, you’re able to leverage machine learning to help determine keywords, search terms and intent that may be more valuable compared to manually reviewing and looking for patterns and opportunities within the account

- Prioritization – With more time on your hands, you can set it on less impactful campaigns or product lines and focus your efforts on your more successful campaigns that you may want more control over.

- Controls Overall Cost-per-Conversion or Cost-per-Acquisition (CPA) – If cost per conversion is a primary metric that you need to focus on controlling, Target CPA can help manage this and dial those costs.

Cons

- Lack of Control – Using any automated strategies means you give up manual control on bids allowing you to make informed adjustments.

- May reduce or throttle bids – Which can lead to reduced clicks, spend and ultimately revenue.

- May reduce or throttle conversions and revenue – This will happen in conjunction with reduced or throttled bids.

- Multiple performance goals – It may be difficult to balance multiple performance goals. An example is maximizing revenue around a target CPA.

- A decrease in Account Management – May lead to situations with less active account management and less-effective spend if you become complacent, letting automated bid strategies handle your account on autopilot with no oversight.

Knowing if this is the right bid strategy is important to reduce wasted spend.

Target CPA Bidding Strategy Considerations

Setting Appropriate Target CPA goals

Determining a reasonable Target CPA from the start will make or break your campaign. We often see this as the root cause of a lot of issues with this bidding strategy. Be careful not to set your goal too aggressively. You don’t want to run into a scenario where bids and traffic end up spiraling or become throttled.

We recommended setting your baseline from historical CPA data with some padding. Instead of your long-term CPA goal or even what it is currently averaging.

For example, if your goal is $75 and it’s currently averaging a CPA of $100, enabling Target CPA with a goal of $75 immediately will likely result in a large decline in visibility and cost/revenue. An aggressive setting or adjustment can create a domino effect resulting in fewer conversions, producing a smaller sample size, and even lowering your conversion rate.

Additionally, we often see that your average CPA in the account ends up lower than this set Target CPA. This would mean if you had set your target CPA higher and worked your way down, you may have found a setting that’s targeting a higher figure than your true goal, but actually generating conversions at the cost you want in the end, allowing for more volume of conversions.

Cost Control vs Revenue Goals

When using CPA, there is a trade-off with controlling CPA costs and overall revenue. When CPCs are adjusted down, you will likely give up impression and click share due to your ad moving into a lower position and reducing its visibility. This is the same as manual bidding, you just have less control and agility balancing multiple considerations such as maximizing or scaling overall revenue or conversion volume.

In many situations, we’ve determined this bidding strategy wasn’t a good fit because the client had a need to balance, maintain or maximize revenue around a target CPA, or was aiming to grow revenue and conversions within profitability targets, rather than simply trying to limit or run at a set CPA.

Where Does Target CPA Make Sense? Campaigns vs. Account

Next, you need to determine where it makes sense to use Target CPA in your account. We recommend testing it in certain campaigns within your account rather than making a more strategic change with your entire account, in case you do run into any challenges using this bidding strategy.

Quality Score and Target CPA

Don’t forget, even though we can’t adjust bids, quality score is still a factor in play and something we can improve with overall ad rank and something we can look to improve visibility without increasing CPCs.

- CTR

- Ad Relevance

- Landing Page Experience

Conversion Tracking

You will, of course, need to set up conversion tracking, but you will also need a sufficient amount of conversions for Google to optimize around. Previously Google recommended a minimum of 15 conversions in 30 days, however, it has since changed. They now recommend 30 conversions in 30 days and don’t suggest a minimum target of conversions.

The more volume and conversion data, the better for the algorithm to make better adjustments that will help long term. If you’re running with lower volume of conversions, you further risk over-correction and throttling if Google is not seeing conversions coming in.

Bidding Increases and Decreases

So now you’re wondering, great! When and how do I reach my goal CPA? While we mentioned you want to set a reasonable Target CPA to start, over time you will work toward your goal CPA by lowering your target gradually and continuing to reassess the performance of your campaign.

The main thing is to not be so aggressive at the beginning that Google loses confidence in the ability to predict hitting your target without large cuts. Ideally, you will transition your bids moderately to keep things as consistent and stable as possible, and let it run and gather data for some time before making another adjustment or cut.

How much you change your Target and how frequently is going to change on a campaign by campaign basis depending on conversion volume, current performance and how aggressive you want to be. So it’s difficult for us to give a specific recommendation on how much to scale back your target. Overall, just think about taking baby steps toward your goal, giving adequate time in between for Google to gather sufficient data. We agree with Google’s recommendation to have at least 30 conversions in 30 days, but the more data the better.

Potential Problems Using Target CPA

Target CPA can be a tricky bidding strategy. You will run into problems with it when you use it on the wrong campaigns.

- Stay away from it if you don’t have enough data. Again, Google needs 30 conversions in 30 days.

- Don’t just set it and forget it. When testing Target CPA you need to check to ensure the strategy is working.

A Case Study For Using Target CPA

We had a B2C e-commerce company with a strict return on ad spend (ROAS) and cost considerations. They are in a competitive, lower average order value industry compared to many others, and even though they were aiming to grow revenue, maintaining consistent profitability and cost-per-sale was a big priority.

Over time we were able to gradually increase their account ad spend while maintaining their ROAS goal of 300%. Looking for continuous improvement, we broke out average order value by product type and used data-based information to determine CPA goals for individual product categories (at the campaign level rather than for the entire account).

Focusing on a single campaign with enough data to understand effectiveness relatively quickly, we were able to make informed decisions based on the test on whether we saw a lift in performance and if Target CPA could be a good fit for the account.

Results of the case study

In this situation, Target CPA was the correct bidding strategy to use. The costs dropped by 50% and we doubled the conversion rate. Before we implemented Target CPA we were spending around $400/day with a 5% conversion rate, and after transitioning were spending $200/day with a 10% conversion rate. Here we did see a similar volume of conversions at half the spend, which is effective at helping dial in and improve profitability, and since that was the primary goal rather than scaling, was a good fit.

A Case Study for Not Using Target CPA

We’ve also encountered situations where we have moved away from target CPA to manual bidding.

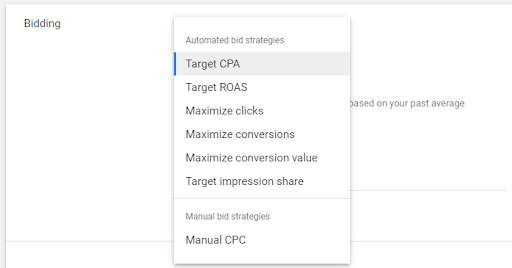

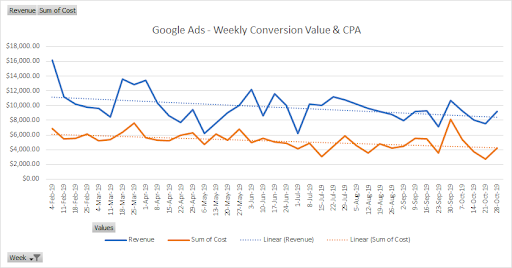

Prior to working with AdShark, our client had opted into Target CPA bidding on a few of their primary campaigns, and had the unintended consequence of revenue declining 35%.

While Target CPA bidding initially looked promising and revenue stable, over the next few months weekly spend, visibility and conversion value began to consistently dwindle.

In this case, using Target CPA led to the bid strategy diverging from the client’s primary goal of maintaining or growing revenue and started prioritizing running at a specific CPA.

This account also has a much higher Lifetime Value of a customer and minimal Cost of Goods sold compared to the previous example, and therefore was less of a single consideration for optimization.

Why did Revenue Decline?

In this case, the account began getting throttled due to CPA thresholds. When running target CPA, Google will manage bidding to attempt and get you as many conversions at your average target CPA that you set.

A common challenge is getting too aggressive with these target goals, which can hurt Google’s ability to bid aggressively. This can lead to situations where accounts spiral into a decline and self-throttle their revenue.

This account had a target CPA that was in line with a higher performance goal, but over time the account performance began to scale back in overall volume and conversions, resulting in a 30% drop in revenue.

Steps Taken

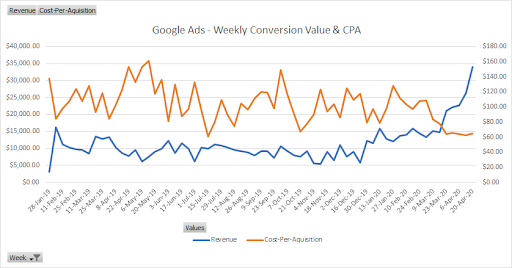

Based on this, when we started working with this client we identified an action plan to improve the account, return to previous levels or revenue and performance and aim to scale and grow while still considering CPA goals.

The two main actions taken included:

- Switching the account to manual CPC bidding

- Restructuring the account and campaigns

Results Switching from Target CPA to Manual CPC

Switching to manual bidding gave us more control over bidding, aggressiveness, visibility, and the ability to scale while making other account changes.

This combined with restructuring the campaign to allow more control over top-performing search terms, and the ability to segment keywords with different levels of performance in intent. As a result, we scaled the account’s revenue 150%-200% over the next 6 months while keeping the CPA fairly consistent early on, and being able to drive it down over time far beyond Target CPA goals.

Is Target CPA Right for You?

Considering whether to switch from manual to automated bidding can be intimidating. And there’s not always a clear choice to make. We want to give you the tools to know what factors to consider before making that transition.

How Can AdShark Marketing Help?

Are you struggling with Automated Bidding strategies? Reach out to us and one of our Digital Marketing Specialists can take a look at your account. We can help you identify why you might be encountering issues with Target CPA bidding in your account.

Ready To Grow?

Let's Talk!